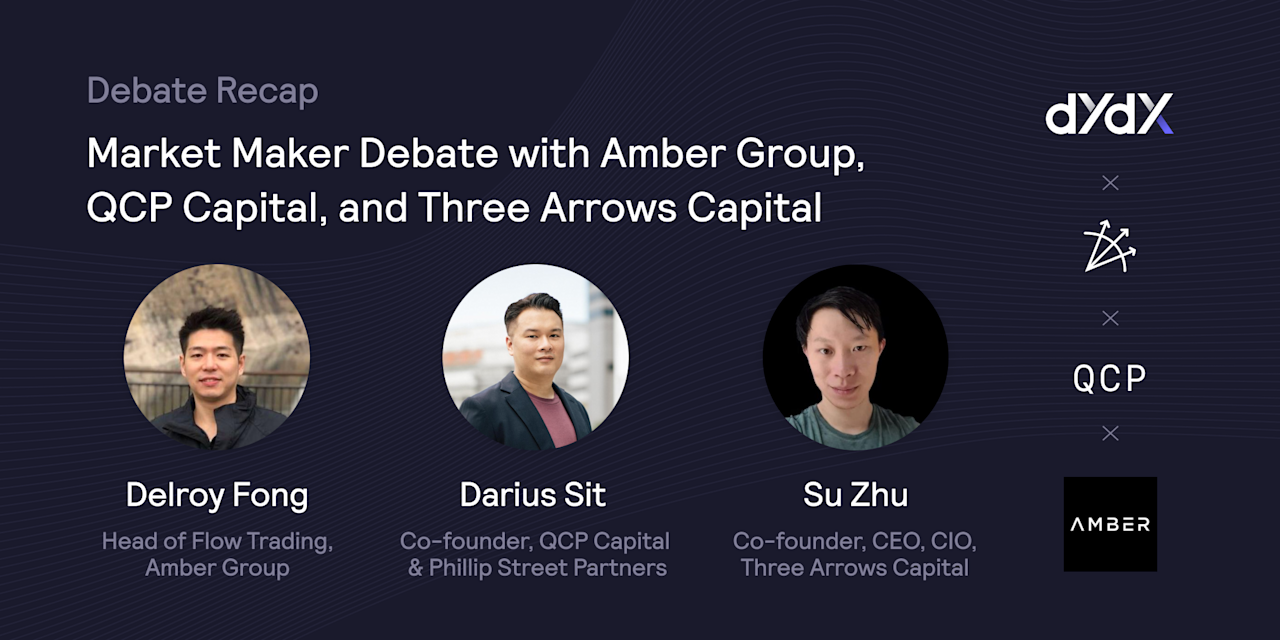

On July 14th, we hosted a debate with Delroy Fong (Head of Flow Trading, Amber Group), Darius Sit (Co-founder, QCP Capital & Phillip Street Partners), and Su Zhu (Co-founder, CEO, CIO Three Arrows Capital). This is the fifth AMA that we're doing in our series focused on market making and institutional trading.

Delroy, Darius, and Su discuss:

Their backgrounds and the story behind Amber, QCP, and Three Arrows Capital

Theses for 2H 2021 and beyond

Crypto market structure

Advice for pro traders looking to get into crypto trading and market making

The evolving role of market makers in crypto and DeFi governance

The advantages and challenges of being based in Asia / Singapore

DeFi vs CeFi competition for price discovery

Everlasting options

AMMs vs. Order Books

The video interview is available here.

A revised transcript is available below:

Vijay (dYdX): Super excited to be bringing this group of all-star traders together today. So just to do a quick headline intro, we have Delroy who is the Head of Flow Trading at Amber Group, Darius, who is co-founder of QCP Capital and Phillip Street Partners, and Su, who is co-founder of Three Arrows Capital. We’re really excited to be having this group together today. Coincidentally, all of them are based in Singapore and are also involved with dYdX perpetual markets to varying levels. So really excited to have you guys with us.

In terms of agenda, the plan is to spend the first 30 minutes focused on intros and round table questions, and then spend the next 45 minutes or so debating some meaty market structure and trading topics before transitioning to audience questions for the last 15 minutes or so. So maybe to kick things off first, could you guys please introduce yourself, your firms, and the types of trading strategies that you run at a high level for the audience. Let's maybe start with Delroy and then over to Darius and then Su.

Delroy (Amber Group): Yeah. So [Amber] was founded in early 2017 by a bunch of ex-Morgan Stanley traders. Since it has come a long way. We're trying to bring traditional finance and capital allocations into the space. So we participate in on-ramp and a little bit of off-ramp and then, ultimately selling products to high net worth individuals and institutions to extract yield in the space or just to trade outright. So in terms of strategies, market-making strategies is one of them. The standard basis, cash and carry, yield extraction from vol curve and rates curve and we do all of that. Of course, some CTA momentum strategies as well, but others are limited.

Vijay (dYdX): Got it. Over to you Darius.

Darius (QCP Capital): So my name is Darius. I came from a hedge fund background, started my career at a hedge fund called Dymon Asia. And then I traded FX at BNP Paribas. Started QCP Capital in 2017. So around the same time as the Amber guys. We are currently a 60 plus man team based in Singapore. We focus on a couple of things. One thing is we quote crypto spot in various local currencies. So Singaporean Dollar, Rupiah, Ringgit, Thai Baht, more of the Asian currencies. We also focus a lot on derivatives. So futures, forwards, options, particularly options. We run a billion-dollar book on options, serving high net worth and family offices as well, various strategies over different coins. And I think there's a big focus for us and we're still growing that business. So yeah, this us in a nutshell.

Su (Three Arrows Capital): So Three Arrows, I co-founded with Kyle Davies in 2012. At that time, mainly focused on emerging market, foreign exchange. And in recent years, focusing mainly on crypto. We are one of the largest traders in the market at this moment. We're a shareholder in Deribit, which is an options exchange, for Bitcoin and Ether options. We also do primary investments in DeFi where we are primarily focused on the Ethereum ecosystem. And in terms of strategies, we run principal capital for the most part, and we're looking to capture both market neutral as well as more directional type of opportunities that come up with the space.

Vijay (dYdX): Awesome. That's a great intro from you guys. I'll hand it over to David to kick off the first of the round table questions that we had.

David (dYdX): Thank you all for joining. So the way that we've structured this debate over the next 90 minutes is we have a number of round table discussions, which will last about five minutes and are more generalized questions for the three panelists. Then we have a few debate questions, which are a little more controversial and will generate more engaged conversation. And the last 15 minutes we'll have some questions from the audience as well. So we asked the audience to keep your questions till the end.

So, to kick things off for the first round table. We're more than halfway through 2021. And the second half of 2021 just started. We saw markets reach all time highs and then, a market correction start in late May. So the first round table question relates to where we are in the overall crypto cycle and what's ahead. So we'd love to hear the panelists’ thoughts on your top three theses for the second half of 2021 and beyond; where should the audience be spending their time researching? So maybe Delroy, you can start, then Darius, and then Su.

Delroy (Amber Group): Cool, I think as a firm, right, we will still think that there will be continual allocation into the space. Traditional finance would continuously be keen into looking at this as a form of a frontier market. So we just look to stablecoin proliferation, adoption by users, either it's just an on-ramp mechanism or eventually they would move it into some form of DeFi to extract yield. This could be the first play. Secondly, on top of this allocation of capital into the space, there will be others looking for additional beta, right? And we've seen this evolving from the last summer through DeFi. And then now, starting to see other things such as NFTs coming into this. So a layer on top of stablecoins or the typical store value in Bitcoin. It's natural to see some of this topical situations arise. NFTs, play-to-earn sort of model.

DeFi used to be a form of that as well, right? You park your capital in there and you get a derivative of a mining output and that appreciates in value because instead of selling it immediately, you wait and it accrues value supporting the corresponding economy. I think this will be the two main plays in terms of topics but, just as all markets, we'll see as well. A third aspect of it would probably be in the form of derivatives becoming more and more a common instrument for people to participate in. And yeah, something like what dYdX offers, it will be great. We have really seen this done very well on all the centralized exchanges, such as the likes of Binance, Deribit.

David (dYdX): That's great. Darius, over to you.

Darius (QCP Capital): Just to follow on from Delroy's point, I think one of the big things we'll see is a lot more institutional participation in the space. We have been talking to a lot of traditional finance players like funds, brokers, dealers, guys who are looking to get their feet wet in crypto. We saw Goldman talk about NDF [non-deliverable forward], a few of the other banks have been following on as well. I think that will open the door for a lot more money to come in and behalf, and they're coming through derivatives instead of spot. So I think that could be interesting, you have a few more curves in the market. You have NDF curve to add on to what we see in… futures curve in CME, futures curve in non-regulated exchanges as well as spot forwards. So I think that would be quite interesting as we see more of these guys come in.

We also think that they are coming in to participate in options as well. So we definitely think there'll be good growth in the options market. We also think that would result in lower implied volatility. So that's the trend we've been seeing since the highs and lows in the last couple of months and it's gradually been coming down is as the forward curves are flat and the whole market is looking. The last decent spot for yield in the option market. And a lot of people have been selling vol. I think that trend will continue as well. So, we are overall constructive on price as always we think that, like Delroy said, more participation, more guys coming into this frontier market will expand the market as a whole. So we are optimistic there, but I think that comes with lower volatility as well.

Su (Three Arrows Capital): I think I definitely agree on the lower volatility decline. I think there are quite a few reasons for that to happen, but I think the biggest is just that volumes are down quite a bit from the high, so you have lower volumes so you naturally get lower volatility as well. And I think people are realizing that it does actually take a lot of money to be able to push the market higher. So I think lower volatility is definitely something that people should expect. I think on the market outlook side, I think there are the reasons to be constructive and I think there are also increasingly more reasons to be defensive as well.

If we view this cycle, having started pre-COVID, then it's been many months already. And I think that the main challenge right now in this space is that we are in sort of a multi-pronged regulatory cycle, which I think can resolve in many different ways that are sort of impossible to analyze from the point of view of purely price action, right? I think the April, May top was generally formed, not necessarily by the Coinbase IPO as commonly thought, rather by the fact that China did a very sudden crackdown on the entire industry, which is still playing out. So I think that event exogenously created a rounded top for us in the markets. And I think that now having had those tops put in on, especially on several altcoins, I think that then the question when the market is, what momentum does it have to be able to regain those?

So I think that with that backdrop in mind, I think that price discovery will eventually come to be the realization that the regulatory cycle is over. The market has digested the realities of the regulatory cycle, that's the full brunt of the Chinese response, or also the full brunt of the U.S. response with the U.S. being sort of multi-tiered with SEC, as well as with the FED. And so I think that is backdrop for being defensive. So I think that there are quite a few questions that the market probably should be asking and rightly so, and I think also using a backdrop or sort of meme stocks coming under attack now, right? Where AMC is down 20, 30, 40%, and payment for order flow and other things are in focus. And so I think that the macro risks that are coming into the space are increasing. So I think that the long-term outlook is there, but I think that the short-term reaction has had its reason.

Vijay (dYdX): Yeah, that makes a lot of sense. Thanks for that guys. Switching gears a bit. In the crypto market, you get a whole range of people, right? You get those who want instant alpha leaks and all the way up to people who are looking for frameworks to inform their own engagement with the market at scale. And so maybe thinking a bit more of the latter, what are some of the top pieces of advice you guys would give to, let's say, a pro-trader, quant or somebody who's sort of interested in approaching crypto markets with a great deal of financial sophistication and potentially market-making? What kind of advice would you guys give to somebody like that? Let's say, somebody who doesn't have a ton of experience in the weeds with crypto and DeFi specifically, right now, but knows how to approach risk and manage risk and think about the world in sort of a framework context. Is there anything, in particular, you would kind of advise to someone like that, in terms of opportunities in the market and sort of what they should be doing right now?

Delroy (Amber Group): So, I think when DeFi first came out, there were a lot of people just pouring capital into the protocols, locking it up. And then towards the end of the DeFi summer in 2020, we saw certain hacked pools. Harvest Finance, right? And they were pretty established yet they went into some problems, right? Yet they went into some problems. Harvest Finance followed by Pickle, being the two, larger ones that actually had problems. And then the market calmed down a little, and then people were talking about bear market resurgence. And thereafter, right after the Biden election... I mean the US presidential elections, we had a Goldilocks situation and the market just took off from there. And then, at the start of this year, you see DeFi coming up again with a lot of TVL. And then, we have a little bit of a fork away from ERC20 mainnet into things like BSC, Terra, the likes of all these other networks. And of course, Solana as well.

So I just think that it's quite a money game, at the end of the day. It's a perpetual hunt for yield. And there is a reason why yields are this high, right? Because it's frontier markets, there is no guarantee on your principle, anything could go wrong. So in short, whatever strategy that you are trying to get into, be it just picking up yield on a protocol, selling vol for BTC, there is a reason why the price is higher, there is a reason why premiums are high, because there's risk that you're willing to take. And yeah, I think all investors should have that basic mindset, that they are willing to lose the capital that they stake. Maybe I'll just pause here and then we can come back later.

Darius (QCP Capital): Yeah, just to follow on Delroy's point, a lot of the alpha is in the market structures. So, just to add little bit there, I think in crypto, we are seeing an evolution in how traditional finance, how the markets are structured there. Let's take a step away from DeFi, take it back to more CeFi stuff, stuff that looks and smells like traditional finance, there's a lot of alpha in the market structures there as well. In spot, forwards, futures, options. For example, perpetuals are a very different way of sort of a hybrid funding mix or evolution of what we see in traditional markets being done differently. And I think there's alpha in there and DeFi is just one more step to that as well. You have a new evolution in the market structure and a much more democratized form of investing and trading. So I think, yeah, in crypto it's constantly evolving on all fronts, right? Both the DeFi and the CeFi front is still evolving. And if someone is new to this space it's worth paying attention and trying to understand the market structures, because I think that's where most of the alpha opportunities may be.

Su (Three Arrows Capital): Yeah, I would definitely agree with that. I think, in recent weeks, the contango or the basis has come in quite a bit, which has caused a lot of people to ask now, where are the yields? Where can I actually earn a market-neutral return or grow a book? So I think that kind of question actually doesn't really have a good answer because fundamentally, those yields are coming from people speculating, right? It's coming from volumes and it's coming from also the demand for being long on leverage. So I think that, that being flushed out, the natural pool of dollars that's available to pay market participants has gone down as well.

But I do think, the market structures are really important to understand if you're keen to extract alpha from the markets. I think that DeFi, increasingly, is a very important part of that picture. So I think that DeFi perps have a very strong value proposition in the next few months and years, because of the fact that people can access new derivatives directly from their non-custodial wallets. So I think that watching the flows there and watching what's going on there is going to be really important.

I think similar to how when perps first came out, early adopters of those platforms, like BitMEX, Deribit, and BitMEX as well, just being able to watch these flows and see what's going on and see how people are positioning. And obviously, even before perps, with Bitfinex, Bitfinex market structure watching has been one of the most important, and continues to be probably the most important barometer of market direction that exists today. So I think market structure is number one. There's almost no concept for me of market output separate from market structure. And personally, everything else flows from that.

David (dYdX): That's great. I guess switching gears just a little. All three of you work at some of the leading market makers in the crypto industry. Obviously market-making is not new to crypto, it exists in traditional finance, but there are new types of market-making activities in crypto and in DeFi more broadly. So, wanted to get your views on how you think the role of a market maker has evolved in crypto and in DeFi now, more specifically, versus traditional finance? Obviously, you guys trade, but you also spend a lot of time on thought leadership and community involvement. We're just curious to hear your thoughts on what does market making in crypto and in DeFi really look like on a day-to-day basis? Delroy, you can kick things off.

Delroy (Amber Group): Yeah, for centralized exchanges, I think it's quite the same in terms of the algorithm, the mechanics there. But of course, with traditional finance that is, but of course, there's less of the notion of co-location, everything is on the cloud. And then, as we move into DeFi, it's totally different then, because most of these protocols already have autonomous market-making algorithms out there. So it's more of an understanding of capital movement, cash movement. And then, some calculation around a hatch mechanism around impermanent loss. And given this notion of gas and network fees and stuff, you need to be quite smart about planning ahead. So of course, dYdX has come a long way, right from the days of being just a layer 1... even posting all this could be a very costly agenda. So imagine you're on Coinbase right now, you put a bid, and then after that, when you decide to cancel that you need to pay a fee. That's quite crazy. So with this evolution of the entire infrastructure for trades, for even order management, it's helped how we think about strategies, and lesser focus on things that used to be very important, such as gas efficiency or gas optimization.

I think as the market evolves further, as things get more and more efficient, I think it might converge towards something similar to what we have seen in traditional finance, whereby you can move capital almost very efficiently from one place to another. But until then, given everything is cloud and decentralized, even to move capital into a centralized avenue, it's through a decentralized perspective. Whereby, you're moving capital from wallets to wallets. Until that happens, then maybe all of this consideration has to still be in place. The lag time in a congested network, moving it out of Binance into Coinbase, or even to your custodians, is always a concern in hectic times.

Darius (QCP Capital): Yeah, just to follow-on from what Delroy said, DeFi's quite interesting, in the sense that it levels the playing field. In traditional markets, you have HFT guys and the whole type of equity trading space has matured quite a lot. It becomes difficult to compete with guys who have a much stronger infrastructure, and then the big boys end up winning. So with DeFi, you have sort of a more level playing field where things are more transparent and there's less focus on infrastructure and speed. And the market structure is a little bit more level.

But at the same time, you have very different ways of doing things and it's constantly evolving as well. Everything's on-chain, the on-chain analytics, and various other ways of extracting alpha. So I don't think there's a straight answer, given the many different ways, different platforms are doing it, and the changes that keep occurring.

But what we have spent a lot of time looking at, and it's still quite new, I think, is the DeFi options market, like nonlinear products, and how DeFi might take that on. We haven't really seen any scalable solution yet and we're hoping to find something interesting, but I think that could be a very interesting area if we start to see more and more solutions and more interesting ideas. At the moment, I think it seems to be a bit of a mix, a scalable solution seems to be a mix of both DeFi and CeFi in the options market. But yeah, no real clear solution yet, but we have been talking to a lot of guys and trying to think of a way to do it ourselves. But definitely something to look at.

David (dYdX): That's great. And we'll be talking a little bit more about the options market in the debate section. Su, over to you.

Su (Three Arrows Capital): I think one of the biggest is market makers are ending up owning a large percentage of the governance tokens. I've seen this since the beginning, really, because makers were the first to start deploying into YFI, to SUSHI. Unlike other parts of crypto, which were more sort of VC-led or fund-led, venture-led, I think DeFi uniquely has been very proprietary trading firm-led, both with our respective firms as well as with other firms. So I think that that is kind of different just in terms of how it's evolved. And for that reason, market makers are more public and make their views heard and understood, as well as sort of the trade-offs that they see in the markets. I think that that's actually pretty healthy, and one of the most important reasons why I think DeFi market structure is, long-term, going to be more sustainable. Because I think the users are sort of more impacting how things evolve.

So I think that you don’t very often don't have this relationship as clear. You'll often have separate pools of rentiers, I guess, or capital owners who will be deciding the fees and deciding the roadmap and sort of doing that. Of course, the trade-off there is that when you have trading firms owning the governance tokens, you constantly need to also think about when new projects come, how does that play into the overall competition in this space? I mean, we see so many different perpetual DeFi protocols

Vijay (dYdX): So maybe while Su reconnects, we can kind of piggyback off that question and, Darius and Delroy, given that market makers are kind of rising in stature in crypto and DeFi, more generally, how do you guys think about community involvement in general and staying on top of the DeFi landscape? Just given that some market makers are sort of evolving into a large class of investors in the space.

Darius (QCP Capital): Yeah, maybe I can start on this one. I mean, it's quite a challenge to keep on top of things because every other day, something new comes up. And very often you're always wondering, which ones are trustworthy and which ones are not. I think the way that we do it, is we... I mean, having been in this space for a long time, we tend to... I mean, I guess the same with Delroy and Su, we tend to know people… we either know the protocol teams directly, or we know people who know them, so that's very helpful for us. Meaning that within our network, we are always able to have some kind of direct line of communication with the various DeFi protocols.

And having some kind of human touch there and being able to chat or communicate is always very useful. It takes away a lot of the uncertainty when it comes to DeFi. And I think we found it the most helpful, just relying on our network to make sure that we are, in some way, in touch and able to connect with most of these teams. An of course, there's some network effect there, you know this protocol and they know another protocol, and that's always very helpful.

Vijay (dYdX): Yeah. It makes sense. How about on your side, Delroy? How does Amber think about that?

Delroy (Amber Group): Yeah, similarly, I think Su touched on the point, and it's an open fact out in the public, all these big trading shops out there, you see SBF actively tweeting about certain projects, getting into governance votes and stuff like that. It's something that Amber has a role in as well. We constantly speak with Foundations, very big ones, the likes of... all the blue chips out there, to try to understand better. And from all this, sometimes there might be forks into other protocols and we would want to see if they would be reliable to support at a primitive stage.

And so, it's undeniable that it's a bit different with traditional finance, in the sense that market makers need to have enough inventory to make markets efficiently in this DeFi avenue. And by virtue of that, by holding onto this inventory, we need to know the foundations well. We need to deploy some sort of engineering resource to check smart contracts and go through the audit before we actually commit further. Of course, in a bull market, I think everybody turns a blind eye to this a little. One simple audit report comes out, retail just apes into it with TVL, and then the next thing you know, market makers are kind of behind the curve because it's not entirely personal capital or prop capital in that sense, because there are other things at play over here.

Vijay (dYdX): Got it. And, Su, so while you had dropped off and reconnected, we were piggybacking off your previous comments and talking about the role of market makers, and sort of community involvement more generally, and how you guys sort of stay on top of the quickly evolving DeFi landscape. Anything you would sort of add to that?

Su (Three Arrows Capital): Yeah. I think DeFi will probably go through a consolidation phase, where I think the highest quality projects will be able to survive and do well. I think that, like Delroy just mentioned, with the bull market, there's sort of this idea that novelty can sustain and it's just forking this and forking that. I think, sort of the hallmark of that was probably something like Iron Titan, which is like a fork of Frax, which itself is built on previous ideas on algorithmic stable coins. And so I think, that I do think we're going to move into a period of focusing back on fundamentals and then back on basics, just things that work really well properly and can kind of scale as well. So I think that this is probably one of the healthiest parts of the market that we're in, where people can come back and say, "What do I actually want to use DeFi for?" As opposed to figuring out how to ape the new thing every day.

David (dYdX): That's great. The last question in this roundtable section. Vijay mentioned earlier, that crypto is global, but all three of you are based in Asia. And in particular, in Singapore. I was curious if you could share with the audience, what are the advantages and challenges of being based in Asia or Singapore? And how would you describe the current sentiment for crypto in Asia after a lot of the news coming out of China? And how are you guys planning for this through your businesses?

Delroy (Amber Group): Maybe I will just chime in here since I've been quite a big proponent of this, ever since I came down this crypto rabbit hole. I think, Singapore in particular, offers quite a clear, regulatory framework around this. There is no real jurisdiction out there right now that offers very clear requirements for that matter, right? So, I mean, this is just specific to Singapore. I mean because of the government's work to track capital through this FinTech route. But Asia, in general, I think it started with, in fact, I heard one of Darius’ previous podcast. And I do agree, why Asia for that matter? Because, somehow we have a lot of currencies that are not deliverable, they're not able to move freely out of the geographical location. The likes of Indonesian rupiah, Philippine peso, stuff like this. We can't just move it offshore that easily. So crypto has been a big enabler in that sense. Not just for retail trying to move their capital away and not so much even about the story of hyperinflation and stuff. Maybe that's more prevalent in other parts of the world. South America for that matter. But, at least in Asia, it's more of simple payment mechanisms.

Just citing an example as well. An Indonesian furniture manufacturer. They need to pay the raw materials that's coming up from other places or they need to collect the output of selling that furniture, for example. All of this fits into the rhetoric of payment. Being enabled very easily through crypto. So yeah, I think this is one of the simple use cases that actually created a spark for stablecoin proliferation. And that's why at the start of this roundtable, I emphasized on-ramp and off-ramps as an important mechanism.

Unfortunately, at this juncture, it's mainly in dollars at the moment. But, we look to continue this work in the region and hopefully one day be able to seamlessly integrate all forms of current fiat currencies into the crypto network or blockchain technology for that matter.

Darius (QCP Capital): Yeah, just to add to Delroy's point. Like you said, the irony of crypto here is that it actually localizes settlement. Meaning that if you are in Indonesia and a Malaysian, you can settle everything in the local currency, and then the cross-border part is in crypto. And that part, which usually has a lot of difficulty in Asia, gets solved because of the blockchain. So what was once a cross-border settlement becomes a local settlement and local settlements are much easier. So in that way, it's made it more efficient. And ironically, that's also the reason why China's been clamping down on this. Because, typically if you are settling renminbi cross-border, the Chinese government has its ears on it. Has tabs on it. But because these settlements are becoming localized. So, guys like renminbi into the stablecoins and then moving to stablecoins out, it becomes a capital flight issue for China. And it's a blind spot, which is why the clampdowns are so aggressive.

So, the thing here is that it's aggressive because crypto has been disruptive in terms of the cross-border settlement. So I think, in Asia, in general with the clampdown in China and Korea. North Asia has been a bit hostile. But Singapore and Southeast Asia have been great. So, in Singapore, you have, like Delroy said, you have a very clear regulatory environment. And also, you have the regulator that's constantly engaging. I think, Su and I were in a discussion of MAS a couple of weeks ago. And even today there's another roundtable about stablecoins and DeFi with the BIS. So, I think the regulators are very proactive in trying to understand the DeFi.

Of course, no clear answers just yet. But, the fact that they are trying to understand it and trying to get a handle on it. I think that's helpful for a lot of us. Because, they are an open door to us, we have an open channel where we can ask them questions and that makes it easy for us and more comfortable for us to operate. So, I think Singapore is definitely a good place and Southeast Asia as well. Countries like Indonesia are very open to crypto and they've made it very easy for crypto businesses to operate there. So, it's a very positive environment. I think it's not really spoken about much. But, Singapore, Southeast Asia has become quite a hub and there's a lot of activity here. I think that's why the three of us, all happen to be here as well.

Vijay (dYdX): Awesome. So, that covers it on the roundtable section here. So I want to just switch gears to the debate that we've teed up. So, you guys have had a preview of it, but for the audience's benefit, the topic that we're going to be focusing on here, it's a two-part topic, but the first is: Can DeFi venues compete with CeFi venues for price discovery, and beyond just being another source for flow trading for market makers? And if so, what would that take? So, that's the first part. And then the second theme that we wanted to touch on is: How does that answer and that thinking differ by trading product? So obviously we've got a range of products in the market: perpetuals, options, spot, and a variety of other structures around that. And so, from a market structure standpoint, does the answer look the same for all of these, or is it different if we want to get to that end state where DeFi is a source of price discovery as well? So very much focused on market structure and DeFi specifically. But with that context, I wanted to open it up to the three of you and see if somebody wanted to stake a claim and come out with a first view here.

Darius (QCP Capital): Maybe I'll start, in terms of price discovery, let's say for a spot product. It's not a zero-sum game. I mean, it's not really a competition. I think DeFi and CeFi, in terms of... It's complementary and it adds on to each other. It becomes an alternate avenue for liquidity and the price discovery is mutual. Meaning that CeFi price discovery will be impacted by DeFi and vice versa. It comes together in one whole market. Especially, if the product settlements are similar. But I think the devil is in the details. Meaning that the price differentials will come from different types of settlement and the nuances in the market structure like we discussed earlier. So I think it creates more opportunities for our members. Because, if you have a very... If the market almost monolithic, it leads to less opportunity. So I think market makers are looking forward to various types of... Both CeFi, DeFi products, and somewhere in between as well. And that creates more opportunities given the more fragmented market structure.

Delroy (Amber Group): I'll chime in as well. I mean, opportunistically for market makers. The more fragmented the market, the more opaque it is, the better the profitability, generally speaking. However, the irony is if it's too cluttered then it's impossible to make markets. And if you're almost hundred percent... 90-something percent, 99% of the market, at that point with no volume at all, it doesn't make sense as well. So I think it's a mix and match. And it depends on the market situation at any one point of time. Zooming into the phrase. Price discovery on DeFi or this? At this juncture, I don't think so. Main volumes are still on centralized exchanges. Of course, certain altcoins given how they bootstrap liquidity and they start off on a DeFi protocol and they get listed on third-tier exchanges, then of course, yes. The main liquidity for that altcoin would still be in DeFi, in decentralized avenues. That's fair enough. But if we are talking about things like Bitcoin, Eth, and given the volumes and the respective derivatives, then centralized exchanges will still be the ones dictating price and unfortunately at this juncture, it's more of decentralized avenues taking some... I mean, some of the very well-known DEX protocols are taking top-notch, top-tier exchanges as price oracles.

So yeah, things like this. So, it's not wrong to say that it's based on the market situation. It's based on market structure. But if, DeFi is able to properly solve issues on gas, latency, then yes. Arguably... And better products, for example. Then arguably there might be a turn or at least catch-up with the volumes and the centralized exchanges can offer. But, right now I think it will be very rare to hear a whale just dumping in a single clip through an AMM pool. I think it would just destroy the intent of trading properly on decentralized avenues.

Darius (QCP Capital): I think about AMM, I think that's something worth discussing. And, whether the AMM is an efficient way of making markets. I think the AMM idea was great. It's scalable. But it's probably not the most efficient way of market-making. Like Delroy said, you have a big flow, it could cause a lot of price distortions. But at the same time, it lends itself to different opportunities as well. Having IL pools and being able to hedge it with various strategies and options. So, I don't think the two exist in isolation at all. And in fact, a mix of both has been a pretty good source of alpha as well.

Su (Three Arrows Capital): Yeah. I think just to chime in, there's still quite some difficulties for whales to want to put on large positions on-chain. Because you have sandwich attacks. You have MEV issues. Front running. And so that's not really a very good environment to be putting large positions in. And from that, if you think about why whales use CeFi. It's also privacy. They don't really have to show people whether they're long or short. They don't have to show people, what they did before. So I think that those kinds of flows will very likely remain in CeFi because of that trusted environment. And so, DeFi would almost have to replicate that same level of trusted environment. So I am optimistic that things that can preserve user privacy on Layer 2. And at the same time, they can guarantee a liquidation engine or guarantee a processing or handling of large positions. Then I think you will see more and more these positions go or go into DeFi as opposed to CeFi. But, you think about the recent flows on exchanges such as Bitfinex. I mean, I think people were opening 10,000 BTC shorts very quickly. In a short period of time. I think that those kinds of flows are very difficult to source in DeFi because of the fact that arbitrageurs in CeFi can arbitrage between exchanges very quickly. And for just 0.2% or 0.3% edge. Whereas in DeFi to be able to have that market-maker, arbitrage capacity, it's much more challenging. So, I think it's still got a long way to go to be able to service that segment of the market. But I think it'll get there.

Darius (QCP Capital): I mean, on that point, I also think that, DeFi lends itself better to linear products like delta one, spot products, perps, futures. But in terms of trading options and other nonlinear products, it becomes a lot more challenging. So, I don't have an answer to this, but I'd be happy to hear what Delroy and Su think about that. In terms of how DeFi could lend itself to... What kind of solutions there could be for nonlinear products?

Delroy (Amber Group): Yeah. I think there's an avenue for that to evolve. But, you previously mentioned as well, there are some more exotic options that are coming up in DeFi. But, although there is a use case by the addressable market and the active users around those are rather limited. Sure, the token price initially pumped up arguably over the bull market. And also because there are certain VCs marketing it and coming, making statements that they are invested into it. But really users around those instruments are quite limited. So I just think that ultimately the market needs to consolidate. So that people understand it better. More sophisticated investors come on board to be able to use these instruments at the end of the day.

I think that's the crux. Something like dYdX, Amber is a big market maker on it. I think we occupy... we take up almost 25 to 30% of the volume at some point of time. Then it's a simple product... perpetuals in traditional finance can be correlated to something like CFD, simple things like this. And then they extend out into other products into alts. They might not even have as much liquidity on other centralized exchanges and that's a winning formula to snatch volume or get volume away from centralized exchanges. But, of course, if somehow your transactional fees even on a sidechain become too expensive, then it doesn't exactly make sense to commit to a decentralized avenue. So I think that there are just more than... There's so many moving parts along the way product safety, security, and what Su mentioned, the notion of privacy, that matters as well. Every other well-known big wallet out there these days. There's so many instruments to stop to watch the movements, and then from there you can reverse... Re-engineer or reverse engineer the trades. So, all of that, all of which contributes a certain parameter on the trade positions and the execution of all this, are expressions of trades.

Su (Three Arrows Capital): I think also... And one of the reasons why I think DeFi would really welcome a consolidation period is because I think a lot of the products that were created in recent months... Because there's this idea of the governance token on top of it that gains value, teams have been generally focused on forking and focused on low-hanging fruit where the governance token. Tokenomics. Pumpanomics tokenomics. And I think that this is always at a cost of actual products. So, I think someone like dYdX which has been around since the beginning of DeFi and also has had no token for that period, that's allowed them to focus on the actual product. Making that people would use, even if they didn't earn a token. I think that's super important because some of these ambitions that... Or claimed ambitions that these projects have, are extremely difficult engineering problems and they are not solved by tokenomics or pumpamentals. So I think that we will definitely see better products over the next 12 months.

David (dYdX): That's really a great discussion guys. I guess the last debate, I think dovetails well with some of the comments on options and nonlinear products. So, obviously, perpetuals are one of the most traded products in crypto and really a major innovation that started in crypto. Introduced to crypto by BitMEX in 2016. For those who don't know, they give traders futures exposure for as long as they want without the need to roll on a quarterly basis or on a dated basis. They also concentrate all their futures liquidity for a given underlier on a given exchange into a single product. And so, most recently, Paradigm released a paper on a new type of derivative product called the everlasting option. For those who don't know, everlasting options give traders long-term options exposure, similarly, without the effort, risk, or expense of rolling positions. Not too dissimilar to the popular perpetual swap. So it was curious to hear the speaker's views on: does the user base for everlasting options, as put forth by Paradigm, look like the user base for regular options, or do everlasting options represent a different type of Greek risk, more similar to perpetuals themselves? And if the options market, which Darius you've spoken a little bit about already, were to take off, what should the market structure for these types of products ideally look like?

Darius (QCP Capital): I think, when the paper came out, we had a quick look at it. It sounds similar to perpetual swaps, but actually I think, the risk profile is very different. It's like perpetual swaps with a lot more leverage, for one, and we just saw priced out for what it might look like. And it didn't seem that feasible because it's just extremely expensive. If you have the position on. So it could be something interesting going forward, but the risk profile and the product itself, it might not be as... Might not be as easy to adopt as perpetual swaps. Perpetual swaps, I think was a genius idea. And it's created a lot growth in the space. But perpetual options, I think, it's going to be a very, very different type of product. And not sure if the market, when it will be a scalable as perpetual swaps.

Delroy (Amber Group): So yeah. I touched on the previous point as well. Ultimately, there could be a good idea given where the market is right now. Okay. Perpetual is being widely popular. Being more efficient than FX forwards and in traditional finance. But arguably something like CFDs as well, whereby you construct some sort of a synthetic exposure, but yet, you don't have to worry about the rolls and you just pay funding. In crypto, it's either a one-hour, eight-hour roll. Typically, in traditional finance, it's a 24-hour roll. You get charged by your CFD broker every 24 hours if you're short, I don't know, S&P index, for example. But, if we talk about this everlasting options, I'm just not sure if there would be a lot of users to it. Whether retail understands it. Retail still plays a very big role in crypto. And even, if you talk about instant, even if you break down institutional flow right now, most of the funds, crypto native funds, are actually somewhat retail-centric. They just got very wealthy and big over the years and they somehow formed funds. But, is that the real sophistication behind using this kind of exotic structures? I'm unaware.

Su (Three Arrows Capital): Yeah. I mean, a general heuristic from traditional markets is that retail likes shorter-dated options and institutions like longer-dated options. So, from that perspective, it's harder to imagine who would want to have an everlasting option. The trend has generally been to go even shorter. So with the growth in binary options, which ended up getting cracked down by regulators, that was like offering people five-minute options or one-minute options and things like this. So, I think that there is that. But, I do think that, in general, the idea of putting more unique structured products, putting more unique things that haven't been done in traditional finance for whatever reason, mainly regulation, trying them out in DeFi. I think that's a good sentiment. I think there will be a lot of stuff that comes out of that. But these specific ideas, it's going to be very hard to predict. AMMs, I mean, to Paradigm's credit, to Uniswap's credit, AMMs when they first came out, no one thought that they would be good. There were a lot of criticisms of it. And they turned out to be an incredibly useful primitive, because users could get some yield on their passive money. So I think that that's something that I think I always try to keep in mind when I'm skeptical because I know too much finance.

David (dYdX): Moving into our closing section. I’m going to throw out a few themes and would love to hear if you think it is a “FUD” or “Signal” in a lightning round. To kick things off: “GBTC unlock” - FUD or Signal?

Darius (QCP Capital): I think that's a neutral one for me. I don't think the unlock is going to cause that much spot selling. GBTC shares are trading at a discount. So I think most of the guys would be holding onto their shares, waiting to get to par before they sort of square it off.

Delroy (Amber Group): Net neutral in my personal opinion, but if you go on Amber’s twitter page, you will see other, well, quite bullish actually. But my personal opinion is just neutral. I think broad market is more important.

Darius (QCP Capital): Yeah. I’d be curious to hear Su’s position because he's one of the biggest holders at GBTC.

Su (Three Arrows Capital): Okay. I think it's neutral. I think that Darius is right. It's already in discount, and it has been unlocking for months now. So the fact that more is unlocking, it's actually not that important. But I do think the market's fixation on GBTC is very telling because it actually shows that there's sort of a lack of focal points. And it's arguably bearish to me that people are focused on it this much, because it reminds me a little bit of Bakkt almost during the bear market where people were talking about Bakkt, talking about Bakkt, because they just lack of things to talk about basically.

David (dYdX): The next rapid signal is “L2 Growth” - FUD or Signal?

Delroy (Amber Group): Signal.

Darius (QCP Capital): Signal as well. No real reason but signal as well.

Su (Three Arrows Capital): L2 growth I think is Signal. I think it's bullish. I think that it allows a lot more applications and allows a lot more use cases of crypto. So...

David (dYdX): Next topic “UNI Governance DeFi Education Fund” - FUD or Signal?

Delroy (Amber Group): Neutral, I think in my opinion.

Darius (QCP Capital): Yeah. I think no real opinion there as well.

Su (Three Arrows Capital): I think it's a little bit bearish. I mean, we're kind of in the spot now where if this goes into a downturn, you're going to end up with a lot of DigixDAO 2.0 type stuff, DigixDAO being a project that ended up being a battle between the team and token holders to get the treasury and value back. So I think that there's going to be a lot more focus on how treasures are managed. Are they slush funds controlled fully by the biggest token holders? Are they something else? How does that actually play out in an environment where people are wondering who's selling and these kinds of things? So I do think that, again, the community focus on it is something that... I mean, it's almost always like this. The community's reaction to something is usually more telling than the thing itself.

David (dYdX): The last one is Miner Extractable Value “MEV” - FUD or Signal?

Delroy (Amber Group): I think this one is a huge topic. I mean, Amber clearly has a position on this kind of things. We have a big position in KeeperDAO. So we like to think it's a good thing. Yeah.

Darius (QCP Capital): I don't have a real opinion on this one, to be honest.

Su (Three Arrows Capital): I think it's too early to say as well. I mean, MEV does give a lot of applications and kind of a lot of business models some kind of a value to capture. On the other hand, given the substitutability of activity across different chains and across different ways of trading, how sustainable is it really that users will pay MEV, especially large amounts of it over a long period of time? And that kind of is a very difficult philosophical question. So I'm pretty neutral on it.

David (dYdX): To wrap things up before opening it up to the audience, are there any exotic perpetuals you would like to see launched in the market.

Darius (QCP Capital): Exotic perpetuals you mean like what coins, right?

Darius (QCP Capital): Well, I mean, we have a very big Bitcoin Cash book. I think there's WBDC and WETH, but there's no Bitcoin Cash. And I'll be happy to see something like that and have more liquidity on the books.

Delroy (Amber Group): I think it would be cool to see more Hashrate instruments out there. I know there are already some and there are some that offer some sort of correlation as well, but I don't think it's enough and there's not enough volume on it for miners to really hedge properly. So they look to doing it using options right now. And if intelligent enough or smart enough design comes about, I think could significantly capture this kind of miner flows.

Su (Three Arrows Capital): Yeah. I think something like a MOVE contract is always good, I think. FTX is kind of genius in inventing the move contract, because they made options kind of really simple, just, "How much do you think this will move by this time?" And so I think I'm actually surprised more DeFi projects haven't considered doing it, because it's just so easy for people to think about. But yeah, I think that that would be good.

Antonio (dYdX): Yeah, David. Maybe I can ask a question if that's cool, if nobody else wants to. We talked about this a little bit before, but I'm curious how you guys think about automated market makers versus order books in DeFi. Automated market makers have obviously become super popular. Wondering what you guys think the reason for this really huge growth in automated market makers has been. And do you think that's sustainable? Do you think automated market makers will be the answer for everything in DeFi? Or is there a place for order books as well?

Delroy (Amber Group): Yeah. I think there is definitely a space for order books, for sure. I think AMMs just come about given it's very easy for project protocols to just bootstrap liquidity at the beginning. And we see that at the start of the DeFi summer last year. And actually, yes, if you're more careful with slippage, the fees that you pay, when amounts are getting larger, you have a very big chunk to unload or buy into, it wouldn't just be in a single clip on an AMM pool. So I think there is always space for both to exist depending on the size, depending on the user, demographic of the user, whether it's retail, institutional, and how sensitive are you to fees and slippage on the execution.

Antonio (dYdX): Right. Makes sense. How do you guys think about something like a Uniswap V3, where, at least for me, I kind of think about that as a bit of a hybrid between an order book and an ANM?

Su (Three Arrows Capital): I think Uni V3, it's a very good idea, but it's going to have a lot of issues with people gaming it. I think there's already talks about the way that people get things included, excluded into blocks. People pulling liquidity within the same block or adding liquidity to be able to get the fee. I think there was some analytics that people have tweeted which showed that just passive money making you basically get no fees. So I think as we add more complexity with these models, traders are incredibly incentivized to make money. So these can be exploited in very novel ways that may end up either strengthening the value proposition long-term or kind of refuting it. So I mean more broadly, I think AMMs, they serve their place, but central limit order book trading is a proven way of trading as well. So I don't see central limit ever being disrupted fully.

Vijay (dYdX): So one more question from my side is that I think, Su you were making a comment around being inspired by traditional finance concepts and thinking about that when deciding sort of what products should be built in DeFi, but that there's also this kind of framework where you don't want to bring too much of that baggage and that knowledge into the space as well given that there's an opportunity to build blue sky products in sort of a community-centric fashion here. So I'm curious, given that all three of you had a background in traditional markets, as well as the crypto markets, for a long time, how do you guys sort of strike a balance there and sort of any heuristics that you guys use to kind of keep a balance between those two?

Darius (QCP Capital): Yeah. I think it's a challenge. It's quite easy to dismiss new DeFi ideas if you're very entrenched in traditional markets. But yeah, for us, I think it's been quite a learning journey and experience trying to sort of... The fun part of it is that it's a new market structure, so you have something new and challenging to figure out and then obviously, you have to assess the risks and then make a decision from there. But always good to put on a little bit of risk to try it out. And I think from what we found, that experience, has been profitable. It's useful to try and understand new market structures from some fundamental pillars that traditional finance has. And obviously, the DeFi markets are in a phase where a lot of new ideas are being thrown out and probably maybe two out of 10 will work in a scalable fashion. So I think it's always important to sort of give it a chance and try it out instead of dismissing it outright, because some of these ideas have been quite scalable. I, myself, also didn't think that AMM would be this scalable, but it's worked very well for small clips and retail. And you underestimate the amount of latent capital in the space that's willing to lend itself to the DeFi space. And that'll probably be a mistake. So I think it's easy to dismiss, but usually worth checking out in small amounts at least at the start.

Delroy (Amber Group): Yeah. That's a mantra that we generally have as well at Amber. In general, if the idea is sound enough and it checks out, then you should always try it, because it could be the next big thing. NFTs, for example, used to be laughed at and stuff, but as we are speaking, this new theme of “play-to-earn” is just shooting through the roof with the broad market trading relatively weak. So things like this. I think if the idea checks out in the beginning, foundation, team, protocol, all adds up, no harm putting something, staking something that you're willing to lose.

The irony of it is if right at the beginning where the product is not even out, but every other big entity talks about it and tries to shoe it, then arguably there's something ambiguous. We have seen some of this stablecoin regimes trying to do this and then they have all of the best investors in town backing them. And when it really launches, it's just too exotic and even the protocol fails in itself. So it's mixed bag really. It depends on the situation. No harm putting in something that you're willing to lose. Never bet everything. And yeah.

Vijay (dYdX): Su, any closing words on that point?

Su (Three Arrows Capital): I'm good. Thanks.

Vijay (dYdX): Cool.

Darius (QCP Capital): All right. Thanks, guys.

Antonio (dYdX): Thanks so much for joining us.

Vijay (dYdX): Cool. Thank you. Bye-bye.

About dYdX

dYdX is the developer of a leading decentralized exchange on a mission to build open, secure, and powerful financial products. dYdX runs on audited smart contracts on Ethereum, which eliminates the need to trust a central exchange while trading. We combine the security and transparency of a decentralized exchange, with the speed and usability of a centralized exchange.